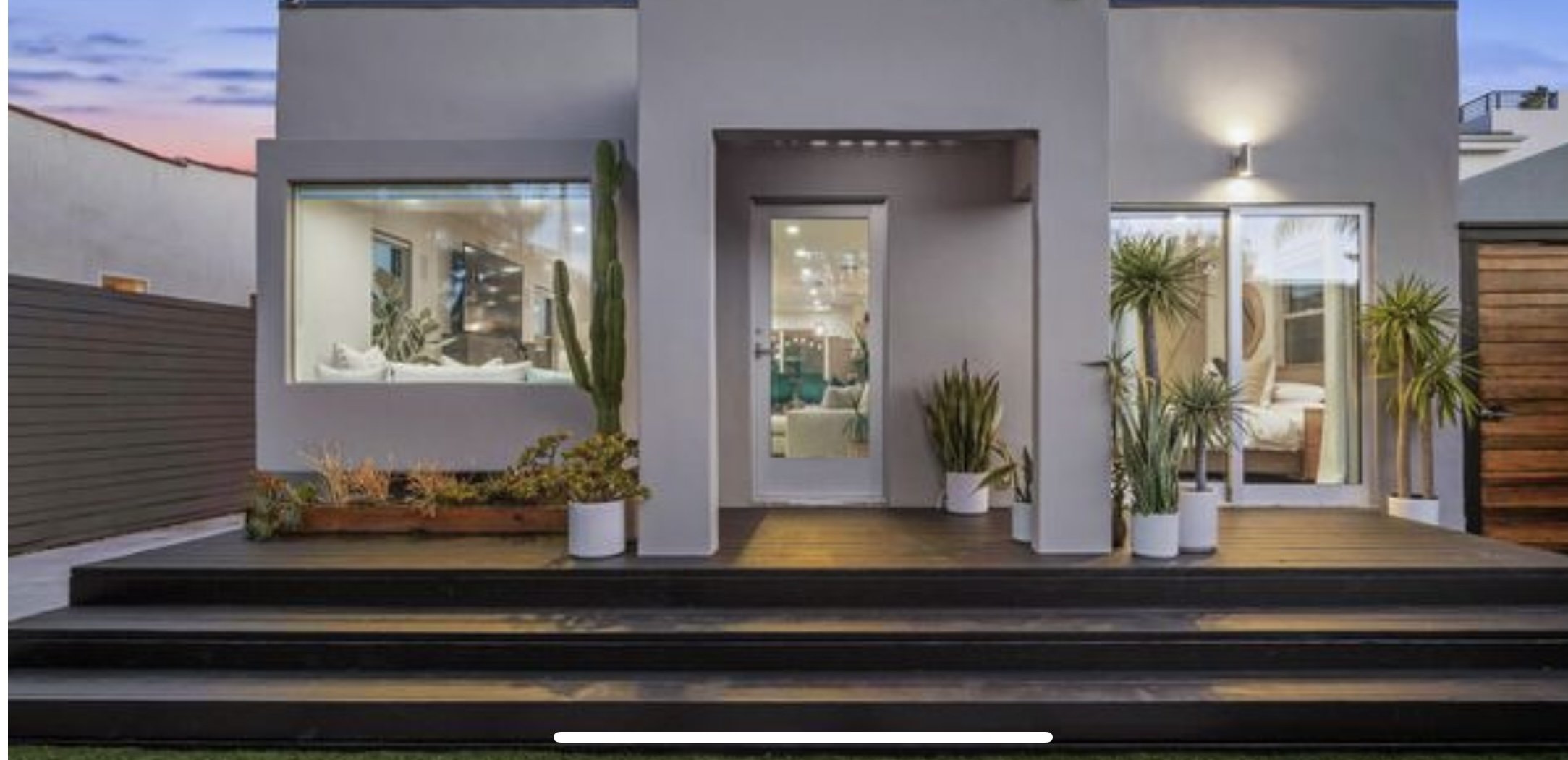

Wait til you see the pool in the back

Venice, California, is a neighborhood located within the city of Los Angeles, California. It is known for its eclectic mix of art, culture, and history. The area has a rich and varied history that dates back to the early 20th century, when it was founded by tobacco millionaire Abbot Kinney.

The story of Venice, California, begins in the early 1900s, when tobacco millionaire Abbot Kinney purchased land in the area with the intention of creating a seaside resort. Kinney believed that the warm climate and beautiful beachfront location would make it a popular destination for tourists. He set out to build a network of canals, similar to those found in the Italian city of Venice, and to develop a variety of amenities and attractions, including a beach, a boardwalk, and a number of hotels and restaurants.

Kinney's vision for Venice quickly became a reality, and the area became a popular destination for tourists and locals alike. The Venice Beach Boardwalk, which opened in the 1920s, was a major attraction, offering visitors a variety of entertainment options, including carnival rides, street performers, and numerous shops and restaurants. In addition, the beach itself was a popular spot for swimming, surfing, and sunbathing.

As the popularity of Venice grew, the area became a hub for the arts, attracting a diverse group of artists and writers. Many of these artists were drawn to the bohemian atmosphere of the area, and they helped to create a unique and vibrant culture that was unlike anything else in Los Angeles. In the 1950s and 1960s, Venice became a center of the counterculture movement, attracting a large number of hippies and other young people who were drawn to its laid-back, alternative lifestyle.

In the decades that followed, Venice underwent a number of changes, as the area evolved and grew. In the 1980s and 1990s, the area became known for its street art and graffiti, and it attracted a large number of artists and musicians who were drawn to the creative atmosphere of the neighborhood. Today, Venice is still a vibrant and creative community, known for its eclectic mix of art, culture, and history.

Despite its many changes over the years, Venice has remained a popular destination for tourists and locals alike. The area is home to a number of interesting and unique attractions, including the famous Venice Beach Boardwalk, the Venice Canals, and the Venice Beach Skate Park. In addition, the area is home to a variety of art galleries, restaurants, and shops, making it a great place to explore and discover something new.

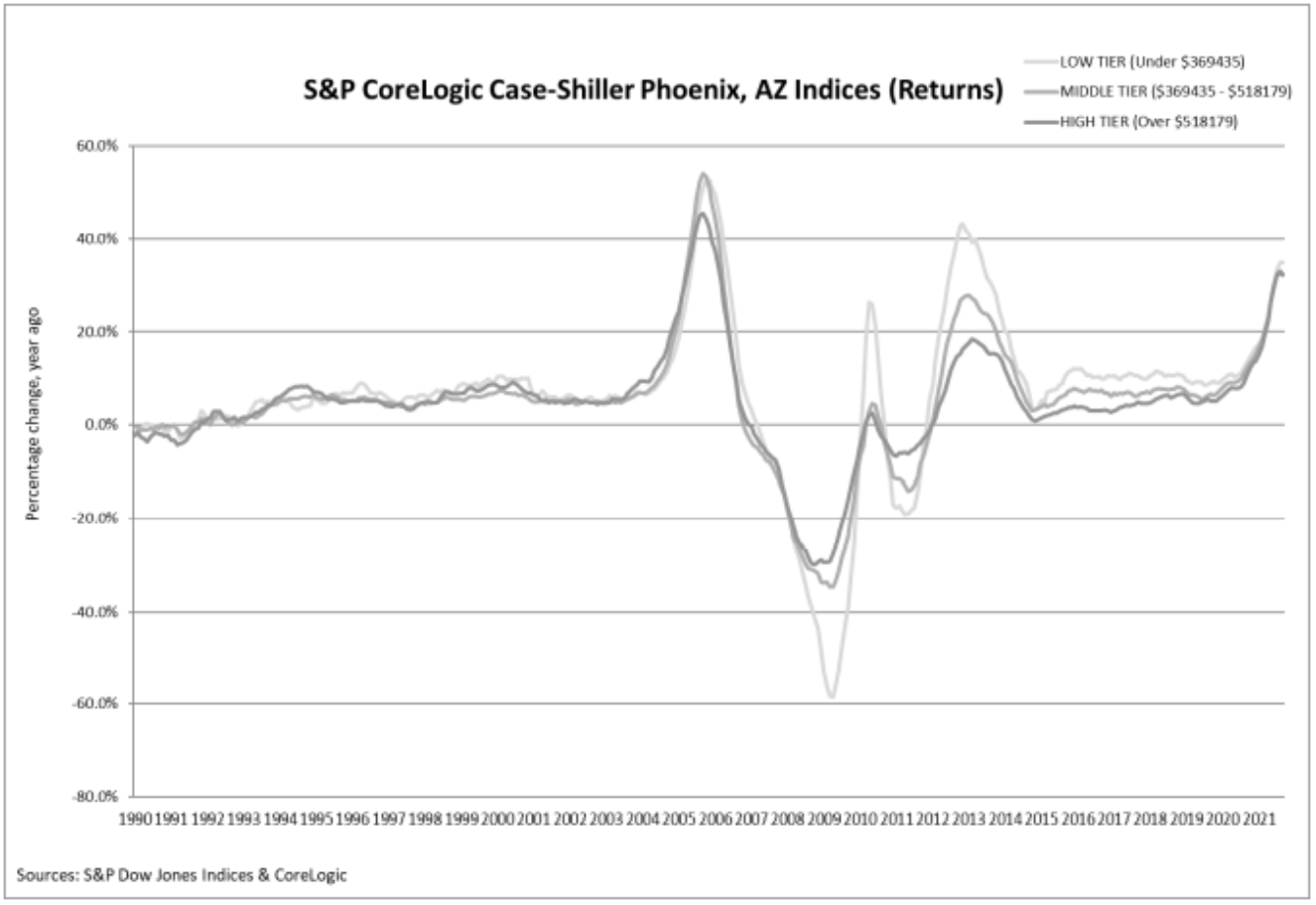

In conclusion, the history of Venice, California, is a rich and varied one, filled with interesting characters, unique cultural developments, and a sense of creativity and innovation that has helped to shape the neighborhood into the vibrant and diverse community it is today. Whether you're interested in its history, its culture, or its beachfront location, Venice is a place that has something for everyone. The booming Tech industry and its well compensated employees are now one of many buyer profiles that Andrew Robarge with COMPASS finds to be typical buyers of great homes like this on listed by Sally Forster jones his teammate at compass. Click here to see dozens of hi res images: https://www.compass.com/listing/1177772480207371849/view?agent_id=60f2188170540700019af4af

Andrew Robarge

COMPASS BEVERLY HILLS

Calbre#01761507